44+ is mortgage interest tax deductible in 2022

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Maximize deductions on homes and other.

Mortgage Interest Deduction How It Calculate Tax Savings

12950 for single filing status 25900 for married.

. Need to easily file federal and state. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Homeowners who bought houses before. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Mortgage interest.

Web HR Block Deluxe Tax Software helps tax filers. Web If you purchased your first home in 2022 congratulations by the way you may be eligible for the First-Time Home Buyers Tax Credit. Homeowners can deduct what they paid in mortgage interest when they file their taxes.

535 to find out if you can deduct the additional interest. Therefore the total itemized is below the standard. Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now.

For the 2022 tax year. Web In 2022 the standard deduction is 12950 for single taxpayers 19400 for heads of household and 25900 for married taxpayers filing a joint return. It also gives them everything they.

However higher limitations 1 million 500000 if married. Ad Access Tax Forms. Web The standard deduction in 2022 is 12950 for single filers and 25900 for couples who are married and filing jointly rising to 13850 and 27700 in 2023.

Web Most homeowners can deduct all of their mortgage interest. Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web If you paid more mortgage interest than is shown on Form 1098 see chapter 4 of Pub. Web Is mortgage interest tax deductible. But for loans taken out from.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Also if your mortgage balance is. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat.

Web Heres how the mortgage interest deduction works and the guidelines and restrictions you need to know plus step-by-step instructions on how to claim it. Reduced by 10 for each 1000. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now.

Complete Edit or Print Tax Forms Instantly. Web You itemize your deductions. If you can include the amount on.

Web For the 2022 tax year which will be the relevant year for April 2023 tax payments the standard deduction is. Prior to 2022 you could only claim up to. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web If you took out your mortgage on or before Oct.

13 1987 your mortgage interest is fully tax deductible without limits. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. For tax year 2022 those amounts are rising to.

Web Thank you for the response but the mortgage interest of 1439500 is reported as zero on schedule A line 8A. 16 2017 then its tax-deductible on mortgages. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web 5 tax deductions for homeowners. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

However even if you meet the criteria above the mortgage insurance premium deduction will be. Taxes Can Be Complex. Taxes Can Be Complex.

Mortgage Interest Deduction How It Works In 2022 Wsj

Mortgage Interest Tax Deduction Smartasset Com

Mortgage Interest Deduction How It Works In 2022 Wsj

Learning Latent Representations Of Bank Customers With The Variational Autoencoder Sciencedirect

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

The Wolf Street F 150 Xlt And Camry Le Price Index Model Year 2022 Update This Is The Craziest Situation I Ve Ever Seen Wolf Street

Mortgage Interest Deduction Rules Limits For 2023

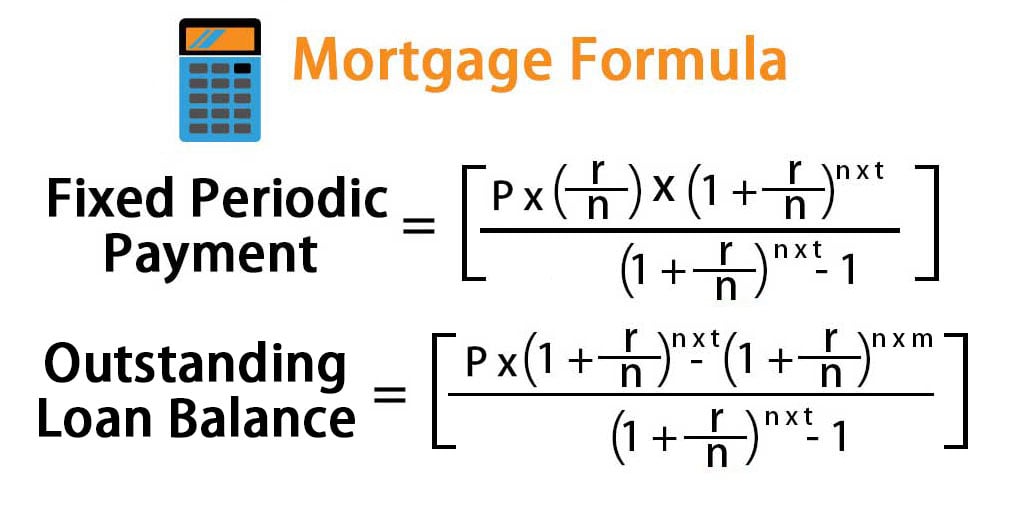

Mortgage Formula Examples With Excel Template

Phan Tich Trong Big Data Pdf

Taxable Income Formula Calculator Examples With Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How Much Mortgage Interest Can I Deduct In 2022

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The History And Possible Future Of The Mortgage Interest Deduction

Mortgage Interest Deduction What You Need To Know For Filing In 2022 Business Salemnews Com

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service